Indonesia’s Mining Sector in Brief

The mining sector in Indonesia is making their way up to be one of the potential leading sectors in Indonesia. According to the Institute for Development of Economics and Finance (INDEF), the mining sector is becoming one of the potential sectors from Indonesia, alongside with the increase of the commodity prices from the mining industry.

The Indonesian government also plans on developing the economy by boosting the mining sector. Some actions implemented by the governments of Indonesia include banning exports of raw mining materials while increasing downstream activities that involves processing of raw materials into value-added goods, hence increasing the selling value of mining products from Indonesia. At the same time, this plan of downstream activities is also expected to create more job opportunities, increase profit margins for the mining commodities, and to cut down carbon emissions.

Mining Production in Indonesia

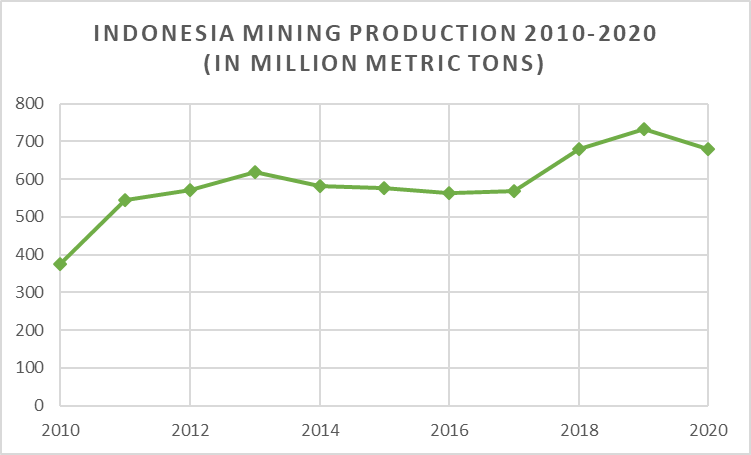

Figure 1. Indonesia Mining Production 2010 – 2020

Source: CEIC Data

Although from 2013 to 2017 the mining production experienced a slight decrease, the overall mining sector in Indonesia can be considered as improving, looking at the significant difference of production amount from 2010 (374.27 million metric tons) to 2019 (679.79 million metric tons). The year 2020 accompanied by the start of the global pandemic showed a decrease in the production amount. However, the amount of mining products established in 2020 is still the second largest amount for these last ten years (679.79 million metric tons).

Figure 2. Indonesia Mining Production 2020

Source: Statista, Ministry of Energy and Mineral Resources Indonesia

The data above illustrates the production of the top mining products in Indonesia in 2020. Most of the mining commodities produced in Indonesia are dominated by Nickel, with a production amount of 35.5 million metric tons, followed by Gold and Silver, and Bauxite (29.96 and 26 million metric tons, respectively).

Mining Export and Import

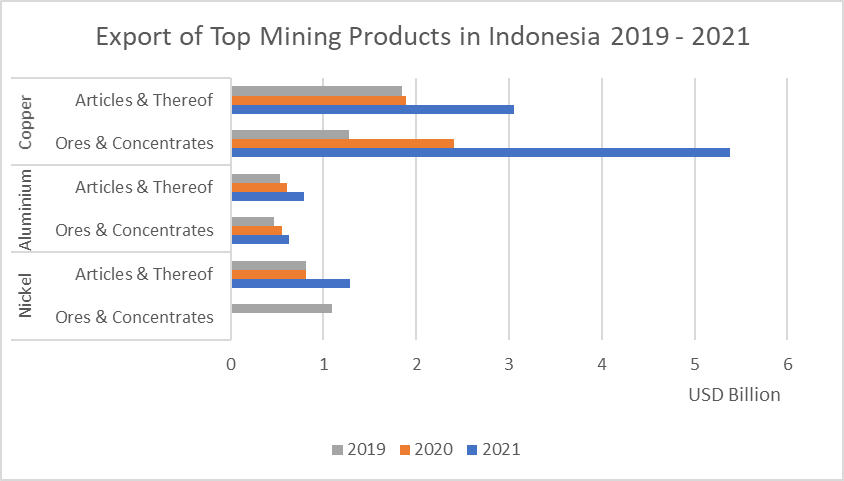

Figures 3 and 4 below depicts the data of export and import of the top three mining products that are the most well-known from Indonesia, which are Copper, Aluminium, and Nickel. The data also illustrates the export and import amount of those products in a form of raw materials (ore and concentrates) and their value-added goods (articles and thereof). Based on the data from Statistics Indonesia (BPS), the top country destination for the export of the 3 mining products is China (USD 8.67 billion) followed by Japan (USD 5.15 billion); whereas the top countries that Indonesia imports from is China (USD 3.06 billion) and Australia (USD 2.32 billion).

Figure 3. Export of Top 3 Mining Products in Indonesia 2019 – 2021

Source: ITC Trade Map

Altogether, it can be seen that the top mining products exported from Indonesia is Copper, specifically in 2021 with the export amount of USD 3.05 billion for nickel ores and concentrates and USD 5.38 billion for copper articles and thereof. Although the amount of Aluminium and Nickel products exported has a quite significant difference from copper, the overall export amounts of all of these 3 goods show an increasing trend, making it a top potential mining product from Indonesia.

A special exception is for nickel ore. The government of Indonesia through the Minister of Energy and Mineral Resources (Minister of ESDM) Regulation Number 11 Year 2019, has banned the export of nickel ore since the beginning of 2020. President Jokowi insisted on banning the exports of raw mining materials, to increase the value-added production in Indonesia, hence increasing net profit margins. The government of Indonesia concludes that this act has increased the surplus of the net export from the mining sector. Other reasons underlying the ban of nickel ore export is to create more job opportunities, and the energy mix must be carried out as soon as possible, both through new and renewable energy, such as hydropower, wind, underwater currents, and geothermal.

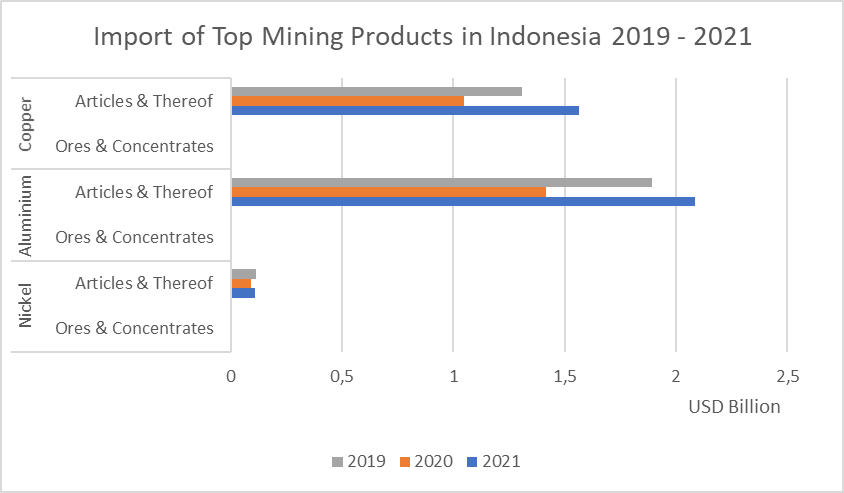

Figure 4. Import of Top 3 Mining Products in Indonesia 2019 – 2021

Source: ITC Trade Map

The import for mining products is dominated by the imports of Aluminium and Copper articles and thereof, specifically in 2021 with the import value of USD 1.56 billion for copper articles and USD 2.08 billion for aluminium articles.

The strict government regulation regarding the enhancement of the raw mining materials in Indonesia has also caused a very significant decrease in imports for raw materials (ores and concentrates). This has also supported the increase of net export from the mining sector, as mentioned beforehand. For instance, the import of nickel ores and concentrates decreased significantly from 2019, as much as USD 4.3 million USD to only USD 10 thousand in 2021.

Investment Projects in Mining Sector

Figure 5. Foreign Direct Investment in Mining Sector 2019-2021

Source: Ministry of Investment Republic Indonesia (BKPM)

The graph shows that the value of investment in Indonesia fluctuates from 2019 (~USD 2.25 billion) until 2021 (~USD 3.8 billion). Even though the number of projects has the smallest amount in 2021, but the highest worth of investment in that year can reflect that investors trust to plant more valuable investments in Indonesia.

According to BKPM, the largest number of projects planted in this sector in 2019-2021 came from Singapore with a total of 713 projects with a value of USD 1.77 billion. However, investors who established the largest investment value came from the United States of America with a worth of USD 2.97 billion or equivalent to 99 projects.

Table 1. Top 5 Mining Investment Project Location Plants in Indonesia:

| No. | Location Plants | Projects | Investment Value (USD Thousand) |

| 1. | Papua | 38 | 2,677,951.6 |

| 2. | East Kalimantan | 300 | 746,674.7 |

| 3. | South Sumatera | 114 | 700,709.3 |

| 4. | North Maluku | 85 | 636,207.8 |

| 5. | South Sulawesi | 39 | 532,897.1 |

Opportunities and Advantages of the Mining Sector in Indonesia

The mining sector is one of the top potential sectors from Indonesia. The growth from this sector is growing rapidly. In 2021, Indonesia experienced an economic growth of 3.69 percent, whereas the mining and quarrying sector itself grew by 4 percent throughout 2021. Furthermore, in the third quarter of 2021 (Q3), the mining and quarrying sector experienced a growth of 7.78 percent YoY. This has broken the record of the highest growth of the mining sector since Q3 1995. The previous highest level was 7.27 percent in Q1 2012, followed by 6.93 percent in Q4 2009. At the same time on Q3 2021, the growth of the mining products itself is increasing, such as the product of metal ores also grew by 24.73 percent (yearly) and a growth of 14.95% for coal and lignite. This has shown the productivity of the mining sector has grown rapidly, indicating that Indonesia can be one of the top countries to produce mining products for both raw materials and value-added goods.

The potential of the mining sector from Indonesia has also proved their competitiveness with an abundance of mineral resources. According to Tony Wenas (President Director of PT Freeport Indonesia) on Mining Talks Discussion at FEB UGM, Indonesia is the world’s third-largest producer of nickel minerals. In addition, Indonesia came in second behind China with a contribution of 39 percent for gold items. As a result, Indonesia is consistently ranked among the top ten countries in the world. The mining industry adds to non-tax state revenue because of its huge potential. Mining businesses employ the concepts of sustainability in the exploitation of natural resources for the greatest prosperity of the people and the accomplishment of Sustainable Development Goals in their implementation (SDGs).

The Ministry of Energy and Mineral Resources (ESDM) also continues to encourage increasing value-added through downstream industries based on mineral mining materials. This is done to support the achievement of emission reduction targets towards Net Zero Emissions alongside to increase added value. They also conclude that mineral commodities such as nickel, copper and cobalt, for example, will play an important role. Especially in the development of the electric battery industry in Indonesia to achieve the Net Zero Emission target. Due to the changing trends of energy transition from fossil to renewable energy and the increased demand of electric batteries for vehicles, Indonesia can be a promising production hub to invest for the production of mining products, looking at the high stock of mineral products stored in the country.